About Us

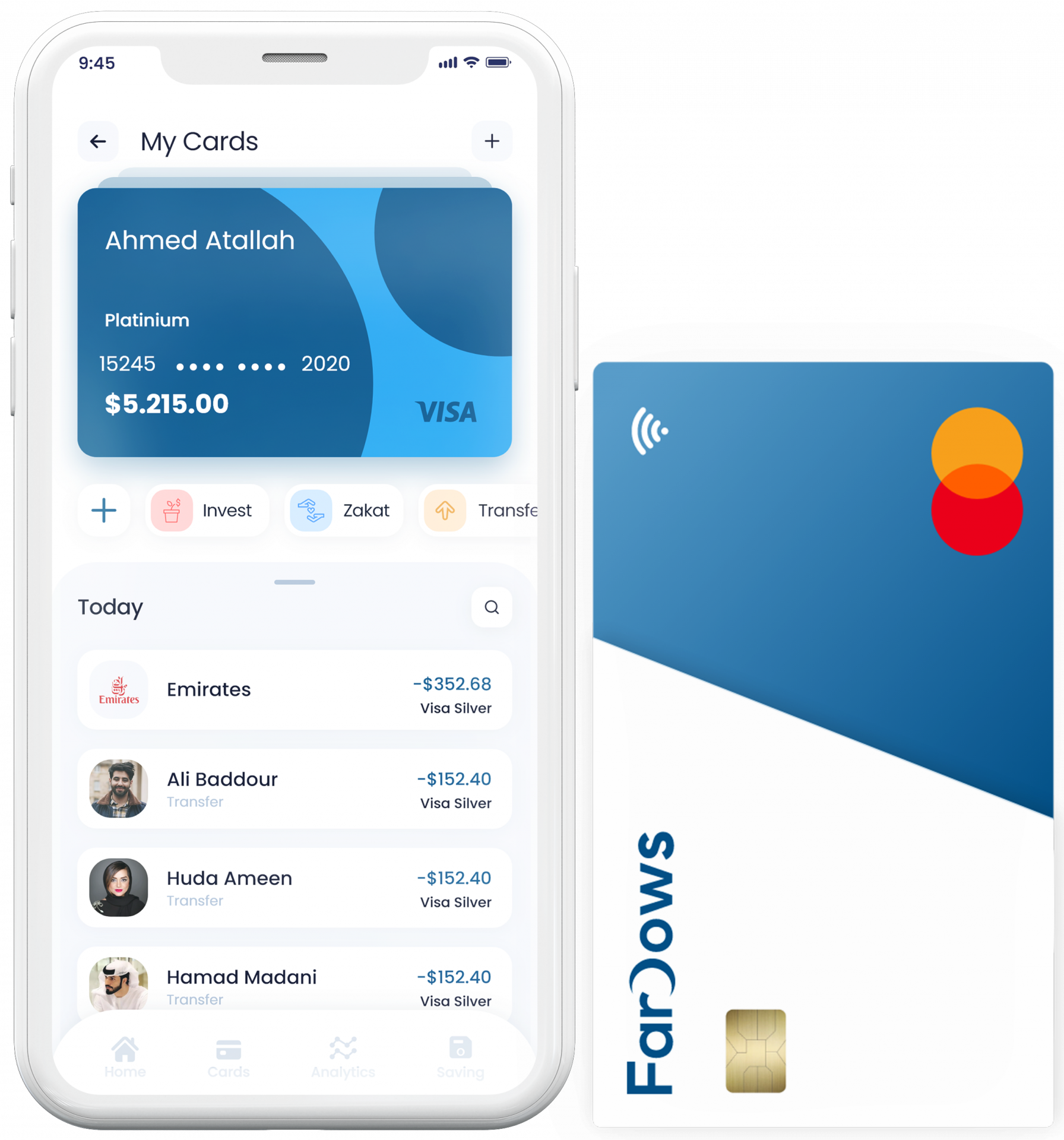

One app for all your

Halal Financial Needs

Fardows is an Islamic financial technology company that allows you to save, spend and invest in a halal and efficient way. Your faith no longer comes secound.

Our Values

We Believe that banking should be

Inclusive

Convenient

Affordable

Relevant

Who we are

We were tired of seeing how much the Muslim community was suffering in the US due to not being able to have halal loans and halal bank accounts. That motivated us to build the world’s first complete Islamic fintech solution. We are currently serving individuals and businesses in the United States and are planning to expand internationally in the near future.

We are driven to provide Muslims with inclusive, convenient, affordable and relevant financial products in a halal way.

why it matters

Islam is the fastest growing religion globally and in the United States. Islam is similarly predicted to become the most popular religion globally by the year 2050. However, the financial needs of Muslims stand largely unmet. The way the current financial industry is structured means Muslims are not allowed to use conventional: checking accounts, credit cards, mortgages, student loans, or insurance. Muslims are also not able to invest in the majority of stocks and ETFs.

Muslims are therefore significantly underbanked and excluded from the financial system in the US. This even holds internationally given that 900 million of the 1.3 billion global unbanked population are Muslims (70%). Studies from the World Bank indicate that increasing access to Islamic banking and financial services would increase financial inclusion.

Fardows’ innovative digital financial products will allow Muslims in the US to finally be able to access Islamic compatible financial products.